Ny Superform-försäljning på Legion

Superform ($UP),an omnichain yield marketplace, which allows users to easily manage assets, earn yield, and perform cross-chain operations, has already attracted significant investor attention.According to CryptoRank data, Superform has raised a total of $10.92 million in investment rounds, including leading investments from Polychain Capital and VanEck, as well as from Circle, Arthur Hayes (founder of BitMEX), and Brian Pellegrino (co-founder of LayerZero). The total token supply is 1 billion, with an initial fully diluted valuation (FDV) of $50.72 million. Public rounds brought in $1.42 million at a token price of $0.0507, representing 2.8% of the total supply.

Superform positions itself as the first user-centric neobank for stablecoins, offering tools for savings, swaps, transfers, and earning the best yields in a single interface. The project has already launched on Avalanche (AVAX) and provides features based on smart accounts: cross-chain portfolio management, rebalancing in one transaction, multi-token deposits and gas payments with stablecoins. A mobile Superform app, a card for spending on-chain assets, and SuperVaults - flexible vaults with automated strategies, are expected soon.

Details of the Sale on Legion

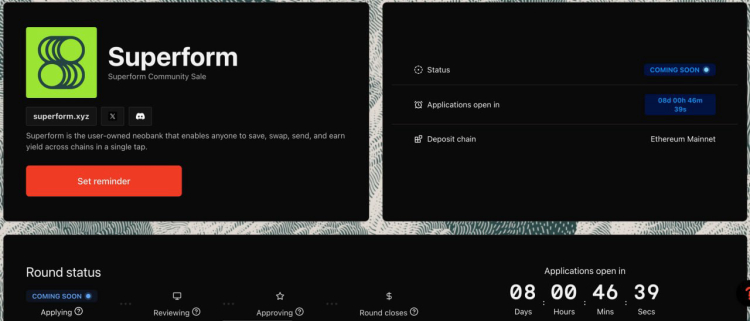

The Superform sale starts on December 4, 2025, on the Cookie launchpad powered by Legion. Applications will open at 13:00 UTC on the Ethereum chain. While detailed conditions and exact dates are not fully disclosed yet, an 8-day timer has been launched on the project page. Users can already set a "Reminder" and prepare accounts for participation.

A key feature of the sale will be a community focus: top Superform participants, Snappers from Cookie Capital Mindshare, and $COOKIE stakers will receive guaranteed allocations on preferential terms. Important warning: Participation is prohibited for residents of the USA, UK, and countries under OFAC sanctions.

Legion has introduced a new tracking system: the platform checks whether you sold your allocation from previous sales. If not - you get priority access or an increased share in future rounds. This is a measure to encourage long-term holders and reduce token dumping immediately after listing. As analysts note, such mechanics can increase value for loyal investors, especially if the FDV is reasonable.

Project Background and Market Context

Superform is no newcomer: the project has been discussed since last year and has already conducted successful rounds. In September 2025, it raised $1.42 million through a sale on Echo for the launch of v2 – a non-custodial neobank for stablecoins. In December 2024, an additional $3 million was raised in a strategic round from VanEck, allowing for team expansion and feature enhancements. The project's TVL exceeded $100 million but has recently dropped below that mark due to competition in the DeFi sector.In the context of the ICO revival (as noted in reports from ChainCatcher and Bitget), platforms like Legion, Echo, and others are transforming speculative hype into sustainable investments. Legion, having raised $5 million to revive ICOs without scams, focuses on a merit-based approach and compliance with MiCA. Projects like Plasma and LAB have delivered high multipliers, but Superform and similar ones have not yet been listed, leaving room for speculation.

Analysts advise monitoring FDV and vesting conditions: if they are favorable, the sale could become a "gem" for DeFi enthusiasts. However, as emphasized in the community, the project has lost some hype due to past delays in distributions (e.g., with $MORPHO) and a complex points system. Nevertheless, with backers like Polychain and integrations (LayerZero, Hyperlane, Jumper), Superform has growth potential.

3 gratis casinos och en bonus på 5% på alla kontantinsättningar.

5 gratisfodral, daglig gratis & bonus

0% avgifter på insättningar och uttag.

11% insättningsbonus + FreeSpin

EXTRA 10% INSÄTTNINGSBONUS + GRATIS 2 HJULSPINN

Gratis case och 100% välkomstbonus

Kommentarer